Managing inventory in the food and agricultural supply chain is no small task—it’s a vital responsibility shaped by the distinct realities of this industry. Think about it: food products can spoil quickly, demand swings with the seasons, and customers’ needs can shift unexpectedly. That’s why thoughtful, strategic inventory planning is essential. It’s the key to ensuring products are always on hand to keep customers happy while avoiding the pitfalls of overstocking, which can tie up cash and rack up unnecessary costs. Done right, it strikes a balance that keeps operations humming and capital working efficiently.

That said, it’s not always smooth sailing. Unpredictable changes in what consumers want, delays in getting raw materials, and market ups and downs can throw a wrench into even the best-laid plans. Without a solid approach to inventory, these challenges can quickly become serious risks for any business. In this piece from Foodex Magazine, we’re diving deep into why inventory planning matters so much in the food world. We’ll unpack the hurdles companies face, explore smart solutions and strategies to boost supply chain performance, and bring it all to life with practical examples you can relate to from the industry.

What Is Supply Chain Inventory?

In the food business, supply chain inventory is everything a company keeps on hand to meet customer needs. Picture the raw materials—like wheat for making flour or fresh fruit for juicing—alongside packaging essentials, such as glass jars for jam or plastic bottles for drinks. Then there are semi-finished items, like pizza dough for ready-made meals, and, of course, the finished goods ready to hit the shelves or be delivered straight to customers.

The whole point of inventory planning and control is to figure out just the right amount of stock to have. It’s about being ready to meet demand without delay while keeping costs in check—think storage fees, spoilage losses, and money sitting idle in unsold products. It’s a delicate dance, but one that’s critical to get right.

Why Is Inventory Planning Important in the Food Supply Chain?

In the food industry, inventory planning isn’t just a good idea—it’s a lifeline. The stakes are high because food doesn’t last forever, customers demand freshness, and seasonal trends can shift the ground beneath you. Plus, people are quick to notice when something’s off. Getting inventory right can make or break customer satisfaction, cut costs, and boost profits. Let’s break down the key reasons why it’s so critical in this sector:

1. Preventing Stockouts and Customer Dissatisfaction

a) Customers don’t like hearing “sorry, we’re out.” They expect their favorite products—like fresh milk or eggs—to be there when they want them, delivered on time. If they’re not, they’ll head straight to a competitor.

b) When stock runs dry, sales slip away, and so does customer loyalty—it’s that simple.

c) For businesses supplying hotels, restaurants, or cafés under contracts, timely delivery isn’t optional. Falling short can mean penalties or even losing those partnerships altogether.

2. Reducing Costs from Excess Inventory

a) Stocking more than you need piles on expenses—warehousing, utilities, and staff time all add up fast.

b) In fields like dairy, meat, or fresh produce, too much inventory doesn’t just sit there—it spoils, turning into a costly loss.

c) If sales don’t match your forecasts, that extra stock ties up cash, leaving less to work with elsewhere.

3. Optimizing Working Capital

a) Smart inventory planning frees up funds, giving businesses room to invest in things like marketing, innovation, or upgrading production.

b) On the flip side, too much inventory locks up cash, limiting flexibility and slowing the company down financially.

4. Improving Operational Efficiency and Timely Delivery

a) Keeping a tight grip on inventory means production and distribution stay on track, lifting the whole supply chain’s performance.

b) It also streamlines warehousing, transportation, and delivery, trimming operational costs along the way.

5. Minimizing Rush Shipping and Emergency Costs

a) When inventory dips too low, companies often scramble, resorting to pricey last-minute fixes—like air-shipping fresh fruits or veggies from far-off suppliers—to meet demand.

b) With solid forecasting and planning, those rushed, budget-busting moves become a thing of the past.

In short, inventory planning in the food supply chain is about staying ahead of the curve. It’s how companies keep customers happy, costs down, and operations running smoothly—all while navigating the unique demands of this fast-moving industry.

Inventory Management and Control Strategies in the Food Industry

As we’ve touched on before, one of the toughest parts of inventory management in the food industry is finding that sweet spot between running out of stock and having too much on hand. When shelves go empty, customers walk away frustrated, and sales slip through your fingers. But if you overstock, you’re stuck with higher storage bills and less cash to keep the business moving. It’s a tricky balance to strike.

To get it right and make inventory work smoothly in the food sector, companies need well-thought-out strategies. In this section, we’re going to walk you through the must-know steps for building and putting these strategies into action. We’ll keep it straightforward and practical, so you can take these ideas and use them to strengthen your supply chain.

Step 1: Analyze and Categorize Products Based on Demand and Perishability

The starting point for any solid inventory control strategy in the food world is to sort your products based on two critical factors:

Demand Level: Is it high or low?

Perishability: Does it spoil quickly or last a while?

Why does this matter? Because every type of product needs its own tailored approach. Take fresh milk, for instance—it’s in high demand and spoils fast, so it requires a completely different game plan than something like cooking oil, which also sells well but sticks around longer. Here’s how we suggest breaking it down:

1. High-Demand, Perishable Products

These are the items that keep you on your toes. They’re popular, but they don’t last long, so you’ve got to plan carefully and stay on top of inventory. Run out, and customers won’t hesitate to shop elsewhere. Stock too much, though, and you’re watching spoilage eat into your profits.

Examples

Fresh dairy products (think milk or yogurt)

Fresh meat and poultry

Fresh fruits and vegetables

Fresh bread and pastries

Key point: For these, it’s all about keeping just enough safety stock to cover your bases and securing quick, reliable deliveries from suppliers.

2. High-Demand, Non-perishable Products

These products can sit on the shelf longer than their perishable cousins. Still, since they’re in high demand, you need to make sure there’s enough to go around—otherwise, you risk disappointing customers and losing sales.

Examples

Rice and legumes

Cooking oil

Various canned goods

Packaged beverages (like bottled water or soda)

Key point: The trick here is nailing down the reorder point and calculating the Economic Order Quantity (EOQ) to keep ordering and storage costs in line.

3. Low-Demand, Perishable Products

This group can be a real challenge. These items don’t fly off the shelves, but they still go bad quickly. Overstock them, and you’re left with spoiled goods and wasted money.

Examples

Niche or specialty cheeses (like rare imported varieties)

Luxury food items with limited appeal (think caviar or specialty desserts)

Rare, pricey seasonal fruits (such as tropical varieties)

Key point: The smartest move here is a Just-in-Time (JIT) approach—only bring them in when you’ve got a confirmed order.

4. Low-Demand, Non-perishable Products

These don’t need to take up much space. Since they don’t spoil, you can keep a set amount on hand and manage them with clear minimum and maximum levels to avoid overdoing it.

Examples

Specialty or imported spices with limited use

Niche dried goods (like luxury nuts that don’t sell fast)

Rare raw materials used now and then in production (such as flavoring essences or specialty additives)

Key point: Stick to a Min-Max inventory strategy to keep stock under control and cut down on unnecessary warehousing expenses.

In the end, it’s all about understanding your products and tailoring your approach. With these strategies, you can tackle the unique demands of the food industry and keep your supply chain running like a well-oiled machine.

Step Two: Accurate Demand Forecasting and Current Inventory Assessment

Once you’ve got your products neatly sorted into categories, the next critical step is to build a reliable demand forecast. Knowing exactly how much of each item you’ll need keeps you from wasting money on too much stock or losing sales because you’ve run out. It’s all about getting it just right, and this stage boils down to three key tasks. Let’s walk through them together.

1. Analyzing Historical Sales Data

The foundation of a good demand forecast starts with looking back at what’s already happened. You’ll want to dig into at least a full year of sales records and ask yourself some straightforward questions:

- Which products sell steadily, no matter the time of year?

- Which ones pick up or drop off depending on the season or specific cycles?

- Are there moments—like holidays or big events—when certain items suddenly take off?

Here’s an example to bring it to life: Imagine an ice cream maker sifting through last year’s numbers. They notice that from June to September, when the sun’s blazing, demand shoots up—about three times higher than the quieter months. That tells them they’ve got to handle inventory with extra care during the summer rush to keep up without overdoing it.

2. Managing Seasonal Shifts and Demand Fluctuations

In the food business, demand doesn’t always stay predictable. It can swing wildly thanks to things like the changing seasons, weather quirks, or special occasions. Picture ice cream flying off the shelves in the heat of summer, or chocolates and sweets piling up in orders around Christmas. These shifts are real, and they matter.

To stay on top of them, here’s what you should do:

Break down your historical sales data by time chunks—think monthly or seasonal trends.

Spot the patterns that keep showing up, then use those insights to plan your inventory for those busy or slow periods with precision.

Getting this right means you won’t end up short on stock when customers come knocking, nor will you tie up cash in products that just sit there. It’s a smarter way to keep your finances flexible and your operations steady.

3. Evaluating Special Events and Their Impact on Demand

Beyond the usual ups and downs, you’ve also got to consider how one-off events or unique factors might shake things up. After poring over your sales history, take a moment to think about what could spark a sudden spike—or drop—in demand. These might include:

Promotional campaigns or tempting discounts that pull customers in.

Seasonal weather shifts that change what people want to eat.

Price jumps or dips in raw materials that ripple through your supply chain.

New trends or cultural shifts that tweak consumer tastes.

Take this example: A company making chocolates and candies knows that demand always surges around Christmas or Valentine’s Day. For those times, their forecasts need to be spot-on—nailing the numbers so they’re ready for the rush without scrambling to catch up or wasting product.

In short, this step is about blending hard data with a keen eye for what’s coming. By forecasting demand accurately and assessing your current inventory, you’re setting the stage for a supply chain that’s responsive, efficient, and ready for whatever the food industry throws your way.

Step Three: Choosing the Right Replenishment Strategy

Now that you’ve categorized your products and forecasted demand, it’s time to figure out how to keep your inventory stocked efficiently. This step is all about picking the best replenishment methods—tailored to your needs—to cut costs and keep stock levels just where they should be. Let’s dive into the strategies, matched to the four product groups we identified earlier.

1. Strategy for High-Demand, Perishable Products

These items are in constant demand but spoil quickly, so the trick is to keep enough on hand to meet customer needs without letting excess pile up and go bad.

Recommended Strategies

Safety Stock: Always have a small cushion of extra inventory ready for those unexpected demand surges.

FIFO (First In – First Out): Make sure the products that arrive first are the ones you sell first—it’s the best way to avoid spoilage or expired goods.

Example: Picture a big grocery store handling fresh milk or yogurt. They use FIFO to move the oldest stock out the door first, and they keep a modest safety stock on hand to cover daily demand without missing a beat.

2. Strategy for High-Demand, Non-perishable Products

These products sell steadily and don’t spoil easily, which gives you a bit more breathing room. Here, the focus shifts to trimming the costs of ordering and storing while ensuring you never run short.

Recommended Strategies

Reorder Point: Decide on a specific stock level that triggers a new order.

Economic Order Quantity (EOQ): Work out the perfect order size that keeps both ordering and storage expenses as low as possible.

Example: Imagine a distributor dealing in rice or cooking oil. They’ve set their reorder point at 1,000 units and their EOQ at 5,000 units. When inventory dips to 1,000, they order 5,000 more—simple, cost-effective, and reliable.

3. Strategy for Low-Demand, Perishable Products

Here’s where it gets tricky: these items don’t sell fast, but they can still spoil. You’ve got to be precise to avoid waste while keeping just enough to meet what little demand there is.

Recommended Strategy

Just in Time (JIT): Only order these products when you’ve got a confirmed customer request or a rock-solid demand forecast to back it up.

Example: Think of a fine-dining restaurant that deals in high-end items like caviar or specialty cheeses. They don’t stock up unless a customer’s order is in hand or they know demand is locked in ahead of time—smart and waste-free.

4. Strategy for Low-Demand, Non-perishable Products

These products last a long time and don’t move quickly, so the goal is to keep inventory lean and avoid tying up cash unnecessarily.

Recommended Strategy

Min-Max Strategy: Set clear minimum and maximum stock levels. When inventory hits the minimum, order just enough to reach the maximum—no more, no less.

Example: Consider a wholesaler handling specialty spices. They’ve decided the minimum stock for an imported spice is 100 kilograms and the maximum is 500 kilograms. When they hit 100 kg, they order exactly 400 kg to top it back up—keeping things controlled and capital free.

Choosing the right replenishment strategy is about matching your approach to what each product demands. With these methods in your toolkit, you can keep costs down, stock levels optimized, and your supply chain running smoothly—no matter what you’re selling.

Step Four: Determining Optimal Inventory Levels and Choosing the Right Tools

At this point, it’s time to get precise about how much inventory you should keep on hand. In this step, we’ll walk you through some proven methods and tools to figure out the perfect stock levels for your products. The goal? Keep costs low and efficiency high. Let’s explore five practical tools for nailing those numbers, along with a key concept—Lead Time Analysis—that ties it all together.

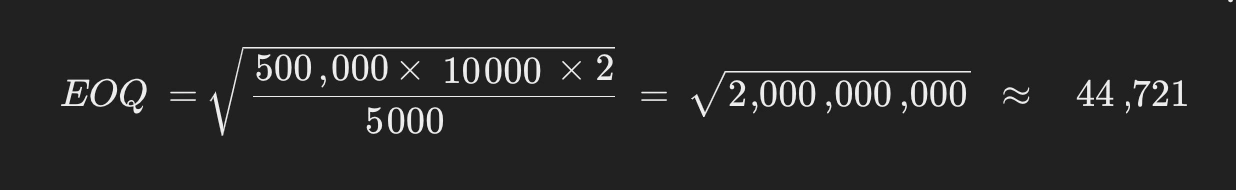

1. Economic Order Quantity (EOQ) Model

The EOQ model is your go-to for deciding how much to order each time. It’s designed to find the sweet spot where the costs of placing orders and storing inventory balance out perfectly.

Where:

D = Annual demand for the product

S = Cost per order (think shipping, paperwork, and operational expenses)

H = Annual holding cost per unit (warehousing, spoilage, insurance, etc.)

Example: Imagine a dairy factory that goes through 10,000 plastic yogurt containers each year. Each order costs them $500, and holding one container for a year runs $5. Plug those numbers into the EOQ formula, and you’ve got a clear answer for the most cost-effective order size.

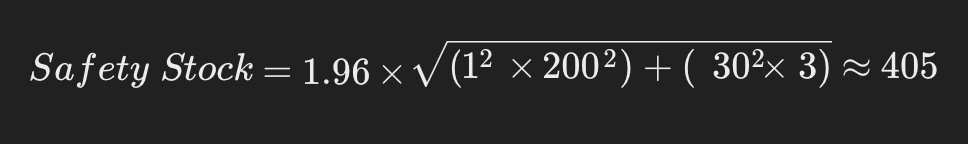

2. Safety Stock Model

Safety stock is that extra layer of inventory you keep as a buffer—ready to handle sudden demand spikes or delays from suppliers.

Where:

Z = Service level factor (say, 1.96 for a 95% confidence level)

LT = Average lead time

𝜎_𝐷 = Standard deviation of demand

𝜎_𝐿𝑇 = Standard deviation of lead time

D = Average daily demand

Example: Take a popular biscuit brand selling 200 packs a day on average, with a 3-day lead time. Demand varies by about 30 packs daily, and lead time shifts by roughly 1 day. Aiming for a 95% service level, they crunch the numbers and land on roughly 405 packs for safety stock. That’s what they’ll keep in reserve to stay prepared.

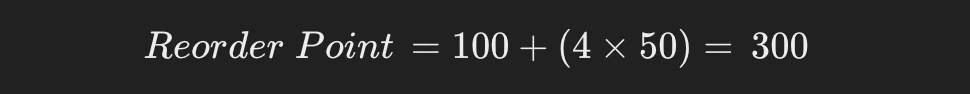

3. Reorder Point (ROP)

The reorder point is that magic number—when your inventory hits this level, it’s time to place a new order to avoid running out.

Where:

D = Daily demand

LT = Average lead time

Safety Stock = Your calculated buffer from above

Example: Picture a retail chain selling cooking oil—50 bottles a day, with a 4-day lead time and a safety stock of 100 bottles. Do the math: (50 × 4) + 100 = 300 bottles. When their stock dips to 300, they know it’s time to reorder.

4. Minimum Order Quantity (MOQ)

MOQ is the smallest amount you can order that still makes sense financially and operationally. Suppliers often set this based on their production limits, shipping logistics, or market needs.

Example: An analyst at a Chicago retail chain sets the MOQ for fresh chicken meat at 2,000 kilograms. Why? That’s what fits the supplier’s refrigerated trucks and keeps transportation costs reasonable. Ordering less just doesn’t add up.

5. Material Requirements Planning (MRP)

MRP is a systematic way to figure out exactly how much raw material you need and when to order it—keeping production on track without overstocking or running short.

Steps to Implement MRP in the Food Industry:

a) Start with a solid forecast of demand for your finished products.

b) Calculate how much raw material each product requires.

c) Pinpoint the exact timing for placing those orders.

d) Stay in close touch with suppliers to ensure everything arrives right on schedule.

Example: A tomato paste factory relies on an MRP system to map out its yearly needs. They determine precisely how much fresh tomatoes, salt, packaging, and metal lids they’ll use—and when to order each one—so they’re never caught short or stuck with excess.

These tools, paired with a sharp understanding of lead time, give you the power to set inventory levels that work. It’s about finding that balance—enough stock to keep things moving, but not so much that costs spiral out of control. With these in your arsenal, you’re well-equipped to keep your supply chain humming efficiently.

Lead Time Analysis

When it comes to figuring out safety stock and reorder points, one factor stands out as absolutely critical: lead time analysis. Simply put, lead time is the stretch between when you place an order and when those goods finally arrive from your supplier. It’s a piece of the puzzle that can make or break your inventory planning.

Why Is Lead Time Analysis Important?

Here’s the deal: the longer and more unpredictable your lead time, the more safety stock you’ll need to keep on hand. That buffer helps you avoid the dreaded stockout scenario. On the flip side, if you can tighten up and predict lead time more accurately, you won’t need as much extra stock. That means lower warehousing costs and more flexibility for your business.

Practical Steps for Lead Time Analysis

So, how do you get a handle on this? It’s a straightforward process:

Step 1: Gather up historical lead time data for each product you deal with.

Step 2: Crunch the numbers to find the average lead time and its standard deviation—how much it tends to vary.

Step 3: Use those insights to sharpen your calculations for safety stock and reorder points.

Example: Picture an ice cream company digging into its records. After reviewing the last 15 orders, they see that key ingredients—like fresh milk and flavorings—take about 4 days to arrive on average, with a standard deviation of 1.2 days. Armed with this, the factory can fine-tune its safety stock and reorder points, sidestepping excess inventory and the costs that come with it.

Final Word: From Inventory Management to Business Success in the Food Industry

Inventory management isn’t just about crunching numbers or keeping shelves stocked—it’s a strategic approach that can transform how your business operates. Through this article, we’ve worked to show you that thoughtful, well-executed inventory planning does more than cut costs. It builds customer loyalty and frees up your company’s capital for smarter, more impactful uses.

Let’s recap the journey we’ve taken together:

First, we delved into how classifying food products with care sets the stage for stronger decisions.

Next, we tackled demand forecasting, turning seasonal shifts in the food industry from a challenge into a chance to master inventory control.

Then, we laid out practical, hands-on strategies to replenish stock—making sure the right products are there, in the right quantities, exactly when they’re needed.

Finally, we brought in tools and models to help you pinpoint optimal inventory levels with precision and efficiency.

But there’s one vital takeaway we can’t overlook: inventory management ties directly to your financial success. When your inventory is running at its best, your capital isn’t just sitting in a warehouse gathering dust—it’s fueling growth and innovation.

So, if you’re ready to take your food industry success to the next level, here’s the bottom line: Your supply chain thrives when it’s backed by skilled professionals and sharp analysts working behind the scenes.

That’s why we’d love for you to check out our next article, where we’ll paint a full picture of expert, data-driven supply chain management:

“The Role of the Supply Chain Analyst in the Food and Agriculture Industry: A Comprehensive Deep Dive”

Here’s something to keep in mind: Solid inventory management helps you stand out from the crowd. But exceptional inventory management? That’s what positions you as a leader in the market.

Thank you for sticking with us at Foodex Iran through this exploration. We’re eager to hear your thoughts and the valuable experiences you bring to the table.

Ehsan Allahverdi

Executive Director, Foodex Iran

Marketing Consultant & Brand Strategist in the Food & Beverage Industry